Rental Property Depreciation Carpet

Repairing after a rental disaster.

Rental property depreciation carpet. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves. Residential property operators 67110. Depreciation is a capital expense. Rental property owner an assessable recoupment under subsection 20 20 3 of the income tax assessment act 1997 where the owner is not carrying on a property rental business and receives the rebate for the purchase of a depreciating asset for example an energy saving appliance for use in the rental property.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be. As such the irs requires you to depreciate them over a 27 5 year. Residential rental property is depreciated at a rate of 3 636 each. Bonus depreciation for rental property owners.

Rental property depreciation basics. Depreciation calculator simple mortgage calculator. Like appliance depreciation carpets are normally depreciated over 5 years. Original cost of carpet.

10 years depreciation charge 1 000 10. Carpet life years remaining. Floor coverings removable without damage. Expected life of carpet.

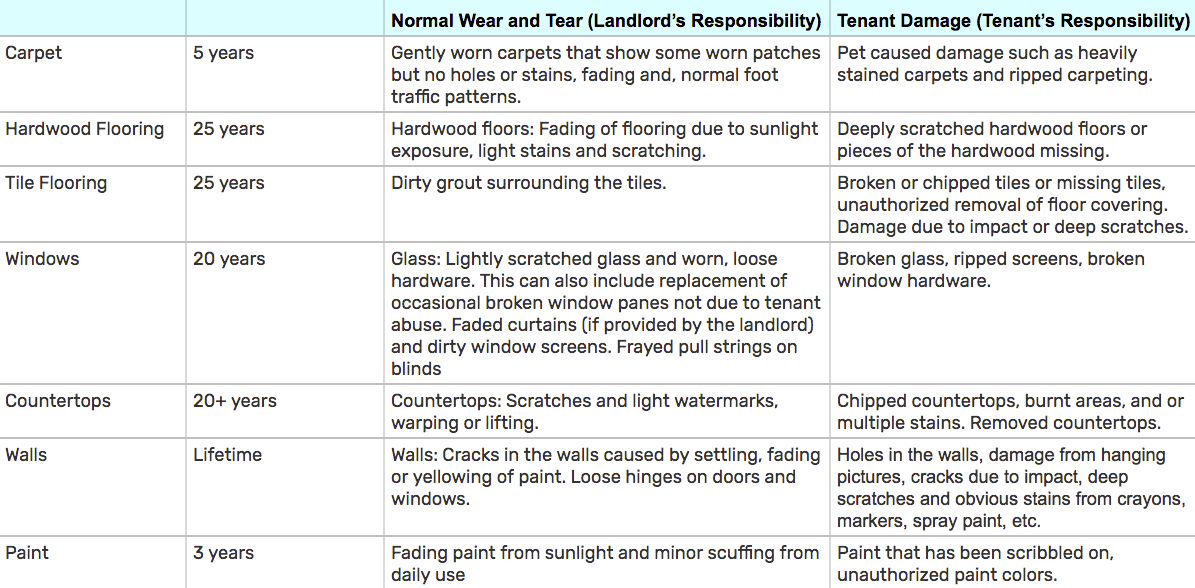

The landlord should properly charge only 200 for the two years worth of life use that would have remained if the tenant had not damaged the carpet. It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property. This applies however only to carpets that are tacked down. Depreciation commences as soon as the property is placed in service or available to use as a rental.

100 per year age of carpet. Rental hiring and real estate services 66110 to 67200. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property. By convention most u s.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years. 10 years 8 years. How to calculate depreciation for real estate can be a head spinning concept for real estate investors but figuring out the tax benefits are well worth it.