Rental Property Carpet Depreciation Ato

It is important to note that in most cases the ato only allows you to backdate depreciation by 2 years.

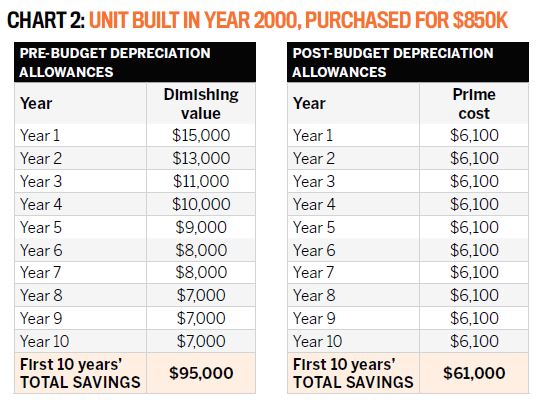

Rental property carpet depreciation ato. Depreciation can be a valuable tool if you invest in rental properties because it allows you to spread out the cost of buying the property over decades thereby reducing each year s tax bill. Depreciation is a capital expense. Generally replacing a worn carpet qualifies as a deductible expense. As such the irs requires you to depreciate them over a 27 5 year.

See placed in service under when does depreciation begin and end in chapter 2. You can begin to depreciate rental property when it is ready and available for rent. Taxation ruling it 2167 income tax. Floor coverings removable without damage.

It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property. Rental property owner an assessable recoupment under subsection 20 20 3 of the income tax assessment act 1997 where the owner is not carrying on a property rental business and receives the rebate for the purchase of a depreciating asset for example an energy saving appliance for use in the rental property. Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

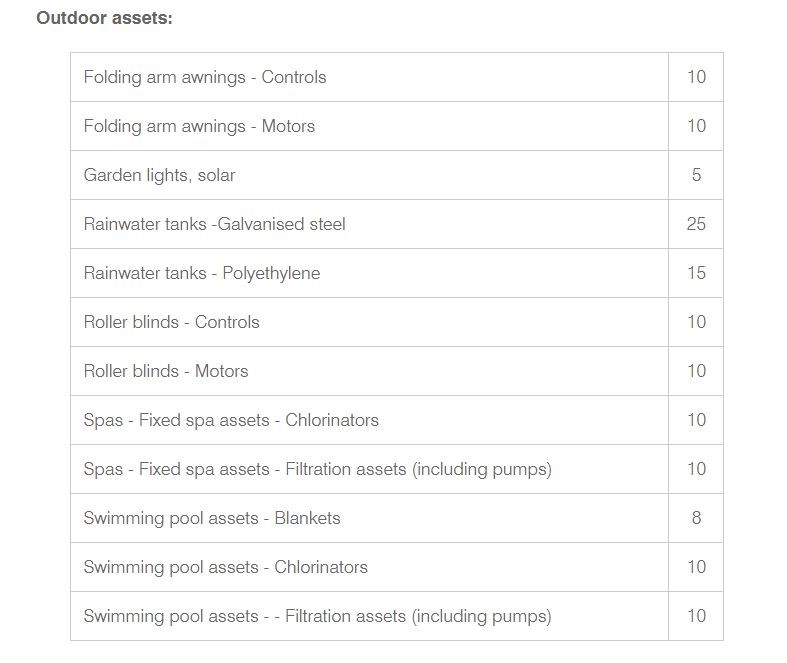

Repairing after a rental disaster. Positive or negative gearing. In order to correctly claim depreciation on your property you need to have what is known as a depreciation schedule written up. Ato depreciation rates 2020.

This is the report that states all your claimable depreciation for tax purposes. Your rental property is positively geared if your deductible expenses are less than the income you earn from the property that is you make a profit from your. Residential property operators 67110. Rental hiring and real estate services 66110 to 67200.

Cases family trust cases. Rental properties non economic rental holiday home share of residence etc. The carpet the washing machine and the fridge.